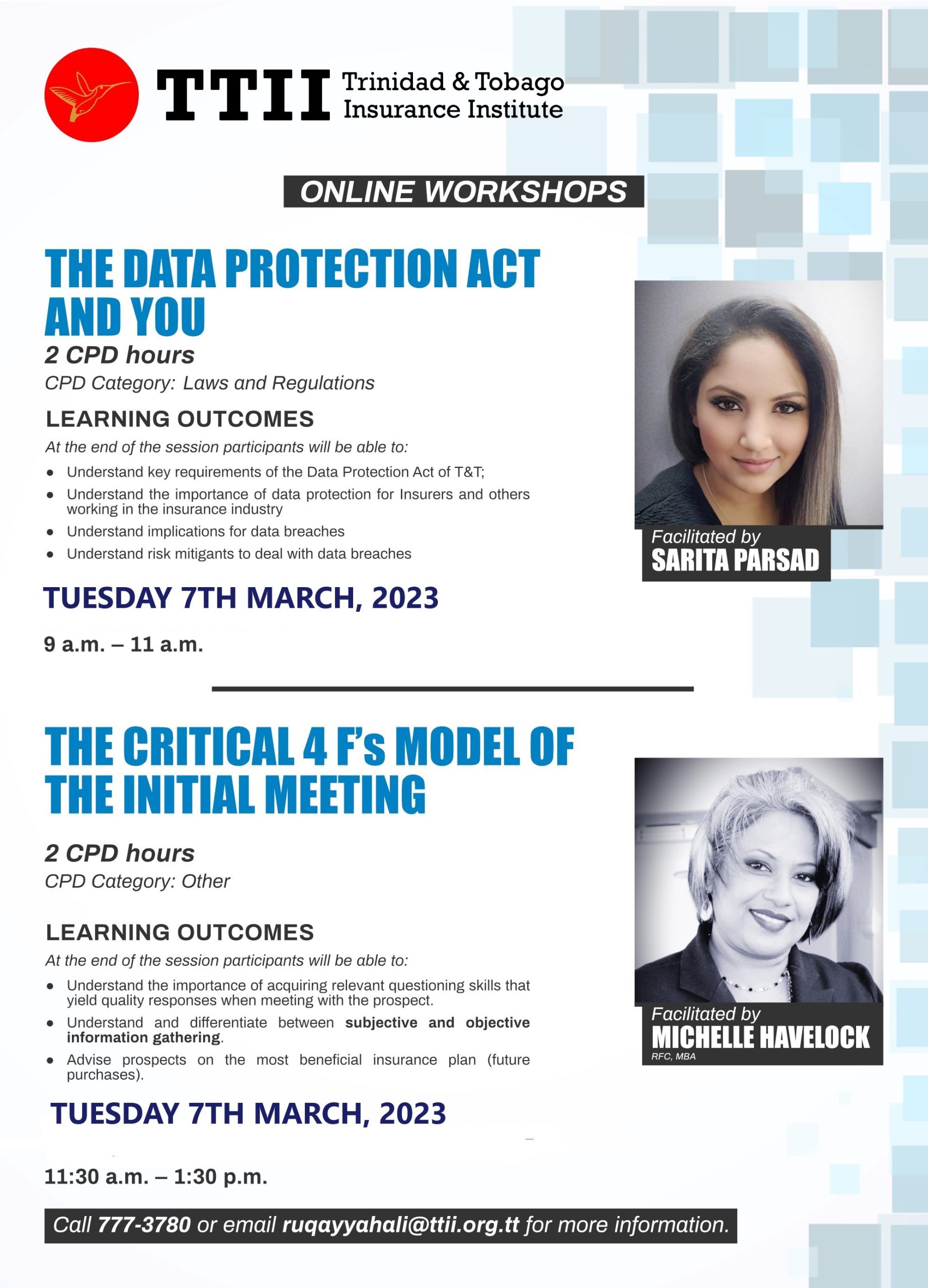

The Data Protection Act and You/Critical 4 F's Model of the Initial Meeting

Price: $0.00

March 7, 2023

The Data Protection Act:

This highly interactive session is designed to provide participants with knowledge and understanding of the Data Protection Act and the importance of data protection for insurers and insurance professionals.

The Critical 4 F’s Model of the Initial Meeting:

This workshop provides a roadmap for intermediaries on the best practices when engaging prospects and existing clients to give them sound and beneficial financial advice most suitable to their needs. Participants will also be educated on the Critical 4Fs Model when engaging with prospects and new clients.

At the end of the session, participants will be able to:

• Understand key requirements of the Data Protection Act of T&T;

• Understand the importance of data protection for Insurers and others working in the insurance industry

• Understand implications for data breaches

• Understand risk mitigants to deal with data breaches

At the end of this workshop participants understand:

The Data Protection Act and You

Sarita Parsad is an Attorney who has been working in the insurance industry for the past fourteen years. She possesses experience handling insurance regulatory matters and all issues pertaining to insurance property and casualty claims. She currently holds the position of Head, Legal & Compliance at Trinidad & Tobago Insurance Limited (TATIL), where she is responsible for all compliance related issues across T&T and Barbados.

Ms. Parsad possesses a Bachelor of Laws Degree (LLB) with honours and a Masters in Law Degree (LLM, Corporate and Commercial Law) from the University of the West Indies, a Master’s Degree in Business Administration (MBA) from Henley School of Business, UK, and an Advanced Diploma (ACII) from the Chartered Insurance Institute in the UK where she is a Member of the Society of Claims Professionals. She is currently enrolled in the Fellowship Program at the Chartered Insurance Institute and actively pursuing an MSc in Insurance and Sustainable Risk Management at Glasgow Caledonian University, UK.

The Critical 4 F’s Model of the Initial Meeting:

Michelle Havelock is the Senior Manager, Sales Learning & Development at the Guardian Group. Michelle brings with her 31 years of experience in the Financial Services industry. She holds a Masters Degree in Business Administration, and is a Registered Financial Consultant (RFC), author, certified trainer and Leadership and Sales Coach and mentor. During her career, Michelle has climbed the corporate ladder holding leadership positions within the Insurance Industry in the areas of business development, recruitment and training, customer retention, sales and sales management training. She is no stranger to the TTII and has served on its Council of Trustees. Her current affiliations include member of the International Association of Insurance and Financial Advisors and now serves as a GAMA Global Caribbean Taskforce Representative for Trinidad & Tobago.

Bookings are closed for this event.