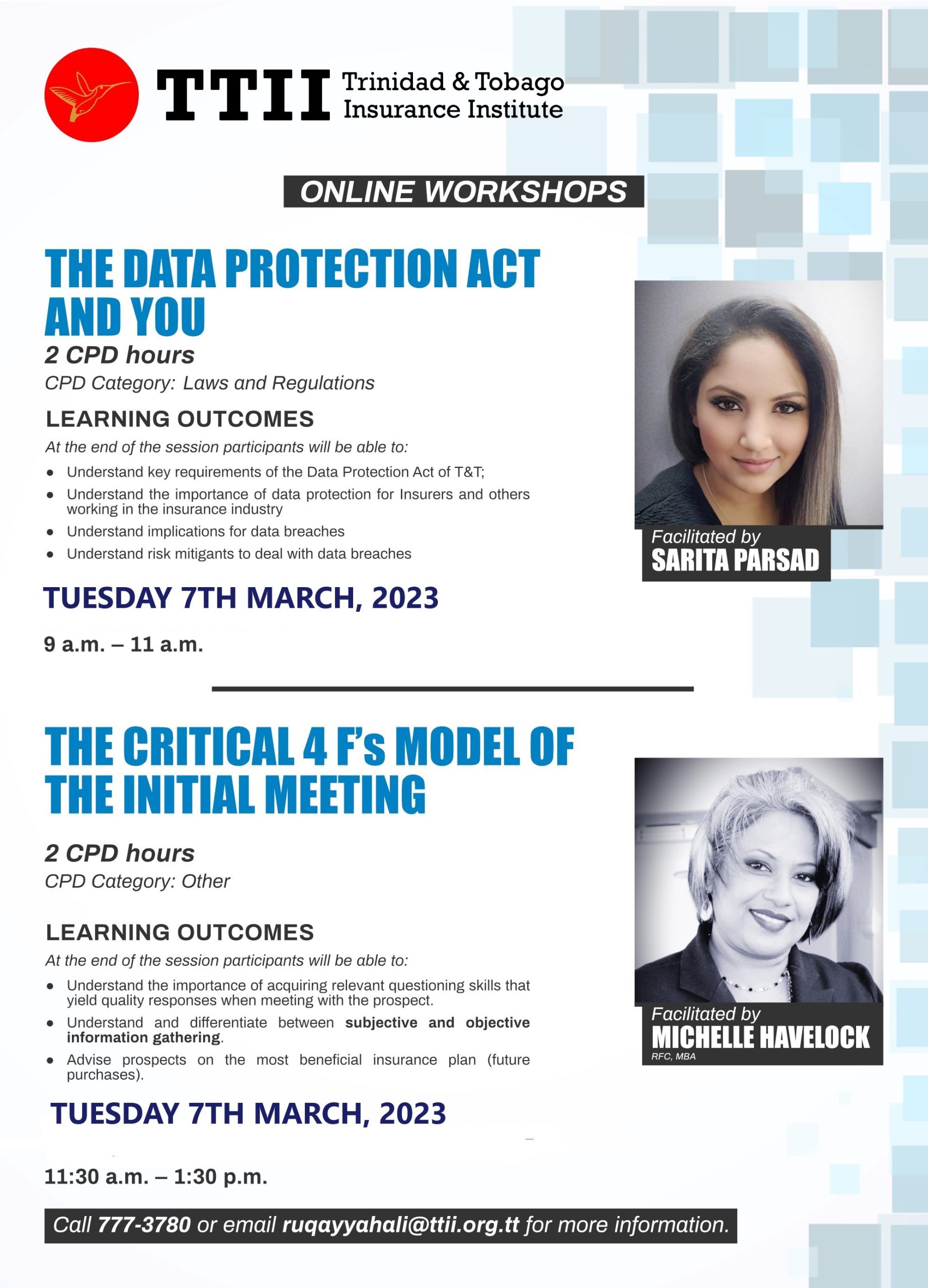

The Data Protection Act:

This highly interactive session is designed to provide participants with knowledge and understanding of the Data Protection Act and the importance of data protection for insurers and insurance professionals.

The Critical 4 F’s Model of the Initial Meeting:

This workshop provides a roadmap for intermediaries on the best practices when engaging prospects and existing clients to give them sound and beneficial financial advice most suitable to their needs. Participants will also be educated on the Critical 4Fs Model when engaging with prospects and new clients.

Bookings are closed for this event.