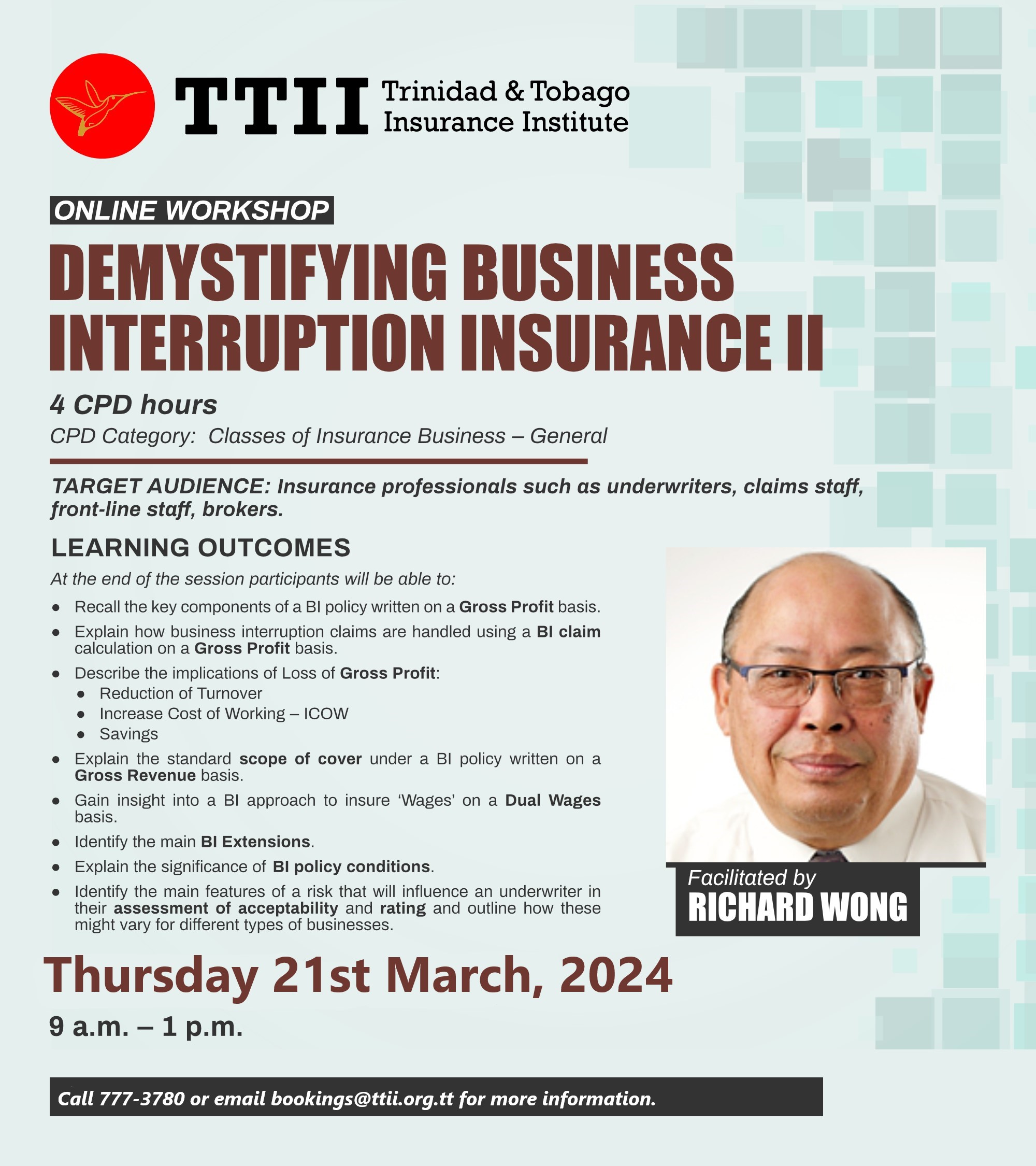

This highly interactive workshop series provides participants with insight into the principles and practices of business interruption insurance. It also explores the aspects which need to be understood by those involved in providing technical or administrative services. It is specifically designed for personnel at insurance, brokerage and loss adjusting companies or organizations whose staff requires in-depth knowledge of Business Interruption Insurance. The assumption is that participants would have attended Part 1 or will have prior advanced knowledge of BI Insurance.

Learning Outcomes

At the end of the sessions participants will be able to:

- Recall the key components of a BI policy written on a Gross Profit basis

- Explain how business interruption claims are handled using a BI claim calculation on a Gross Profit basis

- Describe the implications of Loss of Gross Profit –

- Reduction of Turnover

- Increase Cost of Working – ICOW

- Savings

- Explain the standard scope of cover under a BI policy written on a Gross Revenue basis

- Gain insight into a BI approach to insure ‘Wages’ on a Dual Wages basis

- Identify the main BI Extensions

- Explain the significance of BI policy conditions

Identify the main features of a risk that will influence an underwriter in their

assessment of acceptability and

rating and outline how these might vary for different types of businesses