“Life is full of uncertainties – COVID-19 has highlighted the unpredictability of events. However, we still have to plan for these uncertainties (a bit ironic). That’s is what insurance is about – the products that help support families in their times of need. There have been lots of drastic changes in the past few years that affect how we conduct business coupled with the changing need for certain goods and services which have impacted all financially. As such, we now have to plan for what happens when plans are derailed. This workshop is designed to give some insight into some of the measures that could be taken to transition families during those times of financial challenges while still preserving the purpose of insurance.”

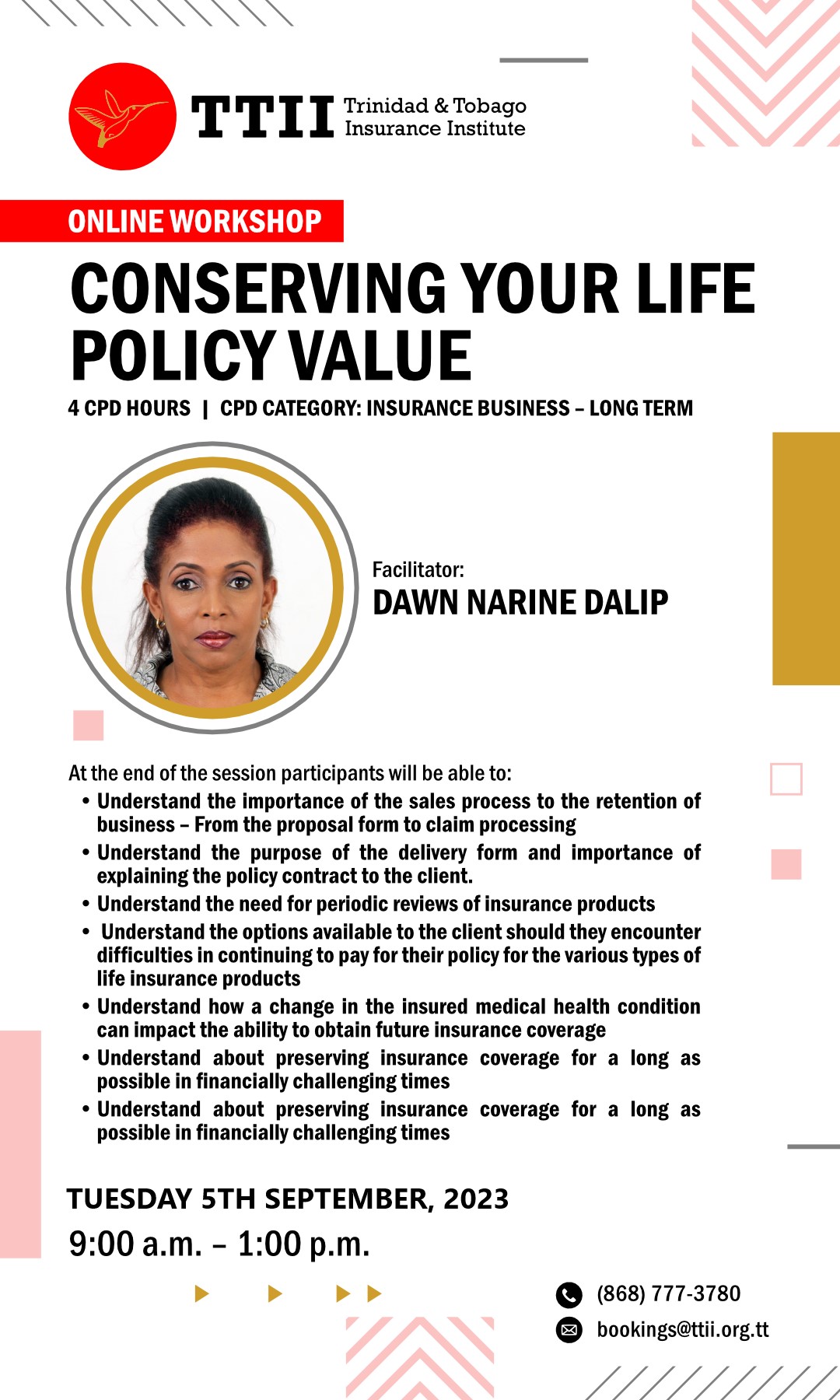

At the end of the session participants will be able to:

- Understand the importance of the sales process to the retention of business – From the proposal form to claim processing

- Understand the purpose of the delivery form and importance of explaining the policy contract to the client.

- Understand the need for periodic reviews of insurance products

- Understand the options available to the client should they encounter difficulties in continuing to pay for their policy for the various types of life insurance products

- Understand how a change in the insured medical health condition can impact the ability to obtain future insurance coverage

- Understand about preserving insurance coverage for a long as possible in financially challenging times

- Understand about preserving insurance coverage for a long as possible in financially challenging times