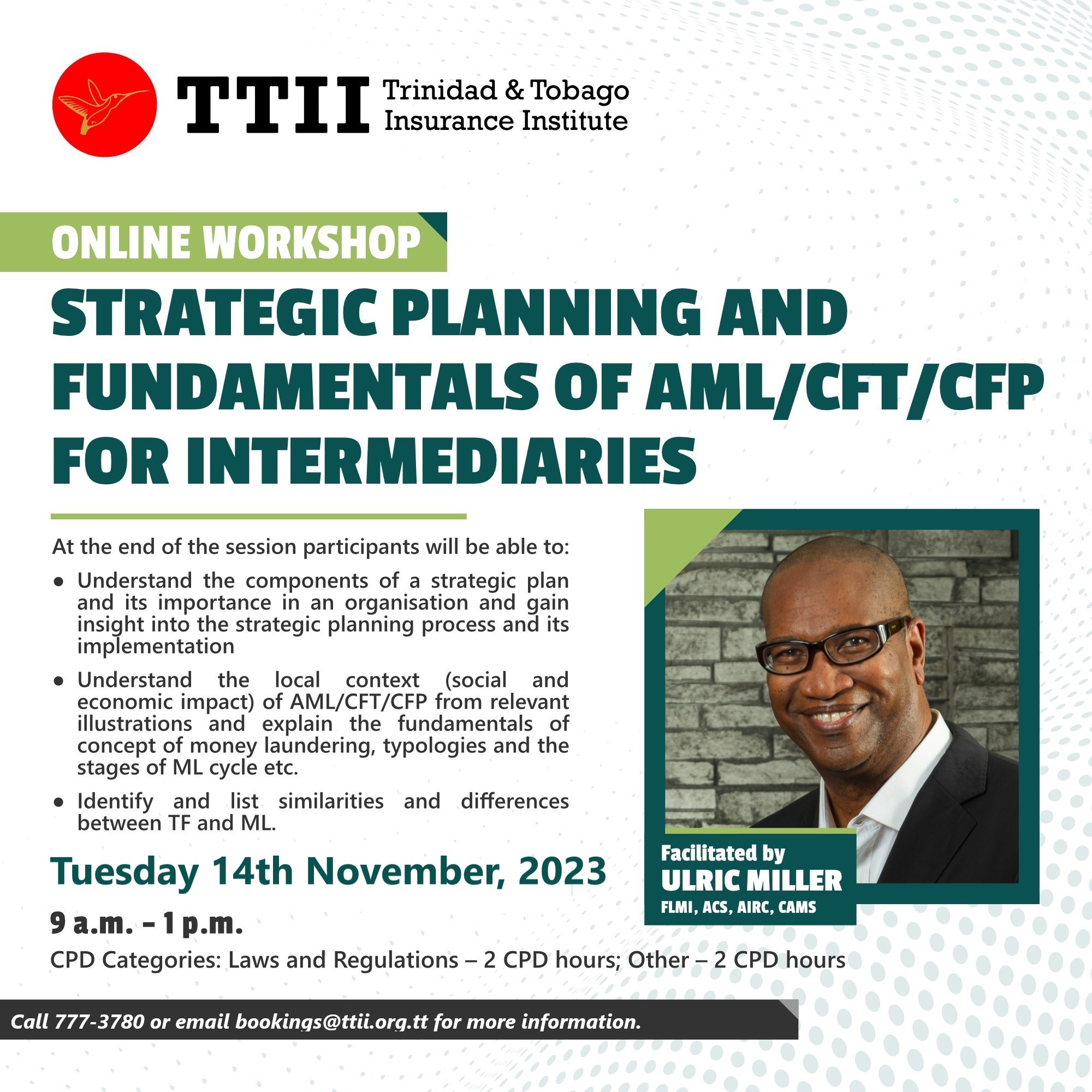

Strategic Planning and Fundamentals of AML/CFT/CFP for Intermediaries

Price: $0.00

November 14, 2023

This workshop is designed to educate participants on how to develop a Strategic Plan utilizing a Strategic Planning process that emphasizes Strategic Leadership, Management and Implementation.

Secondly, insurance intermediaries will gain an understanding into the fundamental concepts of Anti-Money Laundering (AML), Terrorist Financing (TF) and Proliferation Financing (PF) within a local context, along with exposure to the governing legislation.

At the end of the session, participants will be able to:

For Strategic Planning:

- Understand the components of a strategic plan and its importance in an organisation

- Gain insight into the strategic planning process and implementation

- Understand the local context (social and economic impact) of AML/CFT/CFP from relevant illustrations.

- Explain the fundamentals of concept of money laundering, typologies and the stages of ML cycle etc.

- Identify and list similarities and differences between TF and ML.

Mr. Ulric Miller is a certified Anti-Money Laundering Specialist, Fellow of the Life Management Institute, Associate Insurance Regulatory Compliance. In this capacity, he has overseen many AML.CFT Training programmes for the staff at TATIL Life. He has over forty-five (45) years experience in the insurance industry where he started in the IT department and climbed the corporate ladder to Chief Risk Officer of one of the leading insurance companies in Trinidad & Tobago.

He has served as an adept change manager with special experience in leveraging IT, possesses a highly successful track record in Customer Relationship Management, Strategic Management and Scenario Planning. No stranger to the TTII, Mr. Miller has sat as President on the TTII Council of Trustees, President of the local LOMA Society of FLMI’s and 1st VP of the Association of Insurance Institute of the Caribbean.

Bookings are closed for this event.