Recent Life Insurance Cases – What can we learn?

Price: $0.00

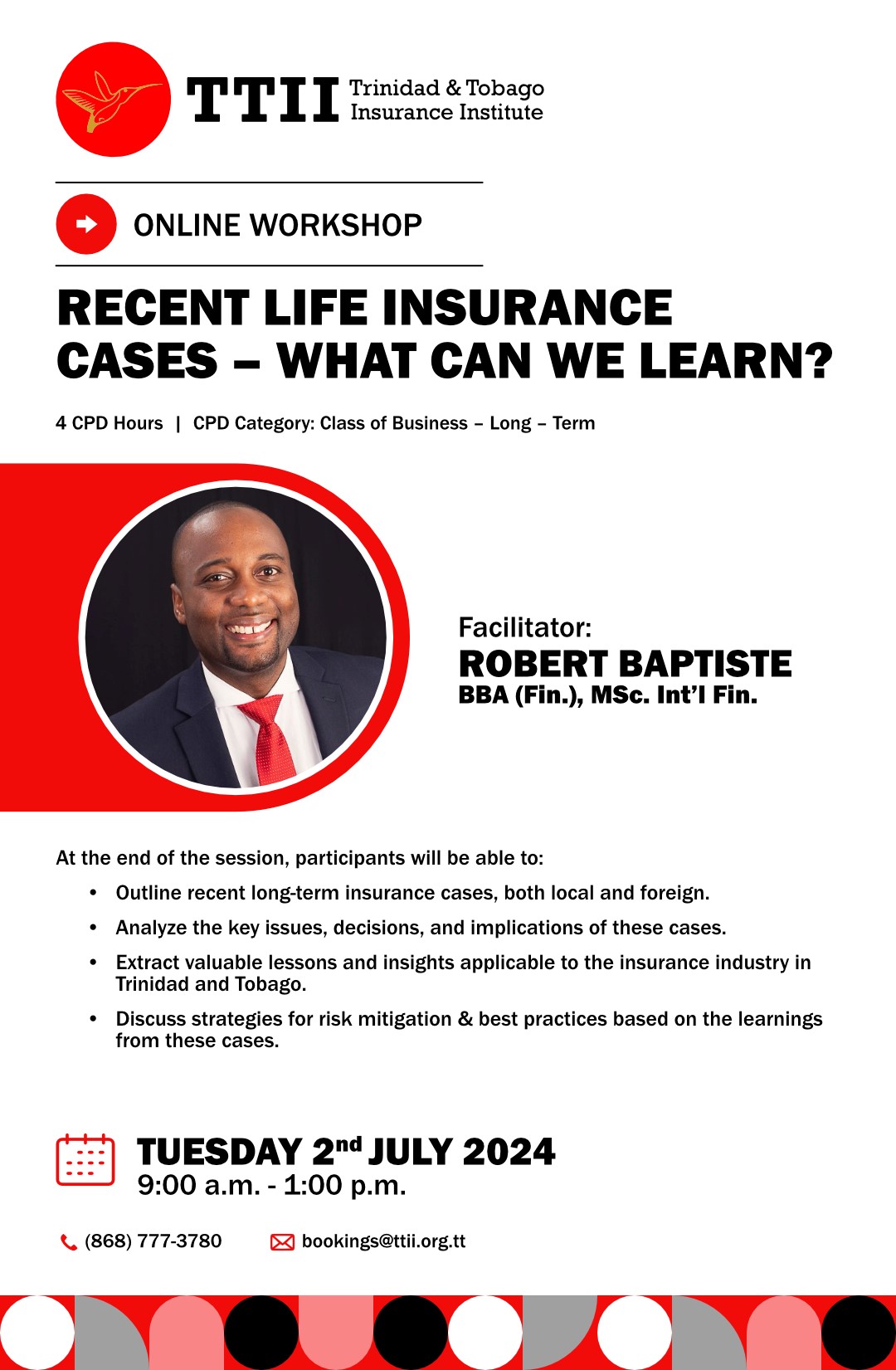

July 2, 2024

This session aims to provide participants with valuable insights and lessons gleaned from recent long-term insurance cases, both locally, regionally and internationally. By reflecting on these cases and discussing their implications, participants will be better equipped to explain long term insurance contracts, mitigate risks, enhance compliance practices and follow approved operational processes within the life insurance industry in Trinidad and Tobago.

At the end of the session, participants will be able to:

- Outline recent long-term insurance cases, both local and foreign.

- Analyze the key issues, decisions, and implications of these cases.

- Extract valuable lessons and insights applicable to the insurance industry in Trinidad and Tobago.

- Discuss strategies for risk mitigation & best practices based on the learnings from these cases.

Robert is an entrepreneurial business leader with a special interest in financial literacy and its role in economic development. He is passionate about the quality of governance and leadership within local and regional organizations. He holds a Bachelors of Business Administration (Finance and Marketing) with Distinction, from the University of New Brunswick, and an MSc in International Finance from the Arthur Lok Jack Global School of Business, UWI.

He is an educator with 20 years’ experience teaching and training locally and internationally. Robert holds the position of Sales Manager at a local multi-line insurance group, and is also a member of faculty attached to the Accounting and Finance Department at a leading tertiary-level institution, where he functions as lecturer, corporate training facilitator, second examiner and consultant course writer. He is owner and principal consultant of a strategic business consulting practice.

Bookings are closed for this event.