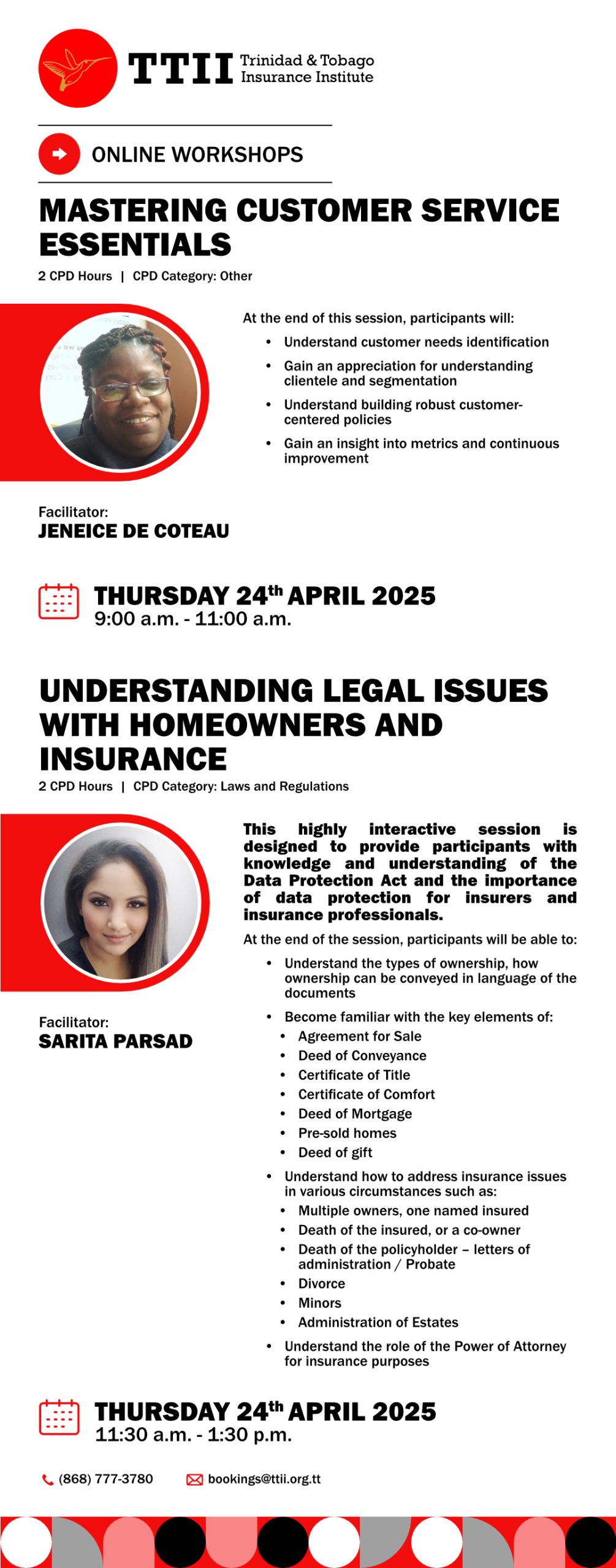

Mastering Customer Service Essentials and Understanding Legal Issues with Homeowners & Insurance

Price: $150.00 - $200.00

April 24, 2025

Mastering Customer Service Essentials

This workshop focuses on key customer service essentials: identifying

customer needs, understanding your clientele, and building customer-centered policies. By adopting a modern and insightful approach, you will empower your team to not only meet but exceed customer expectations.

Understanding Legal Issues with Homeowners & Insurance

This highly interactive session is designed to equip insurance professionals with knowledge and understanding to handle and address key legal issues which may arise in homeowners’ policies.

Mastering Customer Service Essentials

At the end of the session, participants will:

- Understand customer needs identification

- Gain an appreciation for understanding clientele and segmentation

- Understand building robust customer-centered policies

- Gain an insight into metrics and continuous improvement

- Understand the types of ownership, how ownership can be conveyed in language of the documents

- Become familiar with the key elements of:

- Agreement for Sale

- Deed of Conveyance

- Certificate of Title

- Certificate of Comfort

- Deed of Mortgage

- Pre-sold homes

- Deed of gift

- Understand how to address insurance issues in various circumstances such as:

- Multiple owners, one named insured

- Death of the insured, or a co-owner

- Death of the policyholder – letters of administration / Probate

- Divorce

- Minors

- Administration of Estates

- Understand the role of the Power of Attorney for insurance purposes

Mastering Customer Service Essentials

Ms. De Coteau, ACiArb is a distinguished Mediation Conflict Resolution and Alternative Dispute Resolution (ADR) practitioner with extensive experience spanning many years. She has dedicated her career to working with both government and non-governmental agencies, focusing on rehabilitating at-risk communities through the principles of ADR.

Ms. De Coteau is the founder of Officium Training Limited, a company that specializes in mediation and conflict resolution education. She also serves as the Senior Mediator at the Community Conflict Resolution Centre (CCRC), a collaborative initiative between Officium Training Limited and the Trinidad and Tobago Police Service. The CCRC provides mediation and ADR services to the public free of charge, addressing issues such as land and family disputes as part of a broader crime reduction and prevention strategy.

Her work at the CCRC includes overseeing educational outreach programs like the School Conflict Resolution Caravan, which has successfully trained over 20,000 young people in conflict resolution techniques, significantly reducing violence among the youth in schools.

Ms. De Coteau holds qualifications in counseling, which she integrates into her mediation practice to provide comprehensive support to those in conflict.

In addition to her practical work, Ms. De Coteau is an accomplished author. She has written and published the book "Harmony Unveiled: A Basic Guide to Conflict Resolution", and contributed a chapter to the scholarly publication "Prospects and Challenges for Caribbean Societies in and Beyond COVID-19", titled "Adapting Community Development Practice During the COVID-19 Pandemic: A Collaborative Autoethnography of Community Practice in Trinidad and Tobago."

Furthermore, Ms. De Coteau is a renowned conflict resolution educator, facilitator, and conference speaker. Her ongoing commitment to making conflict resolution accessible to everyone, especially at-risk communities, underscores her passion for this field. She continues to enhance her expertise through continuous study and practice, always aiming to foster harmony and understanding in diverse settings.

Understanding Legal Issues with Homeowners & Insurance

Sarita Parsad is an Attorney-at-law who currently holds the position of Head, Legal & Compliance at Trinidad & Tobago Insurance Limited (TATIL) where she is responsible for all compliance related issues across T & T and Barbados. She has fifteen (15) years’ experience in the industry and is versed in dealing with insurance regulatory matters and all issues pertaining to insurance property and casualty claims.

Ms. Parsad is a highly qualified professional holding an MSc in Insurance & Sustainable Risk Management from Glasgow Caledonian University, UK Masters in Law Degree (LLM, Corporate and Commercial Law) from the University of the West Indies, a Master’s Degree in Business Administration (MBA) from Henley School of Business, UK, a Bachelor of Laws Degree (LLB) and an Advanced Diploma (ACII) from the Chartered Insurance Institute in the UK where she is a Member of the Society of Claims Professionals. She is currently enrolled in the Fellowship Program at the Chartered Insurance Institute.

Sarita also provides her expertise on compliance and education in the insurance industry as an active member of ATTIC’s FRAC Committee and the TTII’s Council of Trustees.

Do you already have an account with us? Sign In

Log in if you already have an account with us.