This highly interactive workshop series provides participants with insight into the principles and practices of business interruption insurance. It also explores the aspects which need to be understood by those involved in providing technical or administrative services. It is specifically designed for personnel at insurance, brokerage and loss adjusting companies or organizations whose staff requires in-depth knowledge of Business Interruption Insurance. Participants should have a sound knowledge of fire insurance or be a Business Continuity Professional.

Learning Outcomes

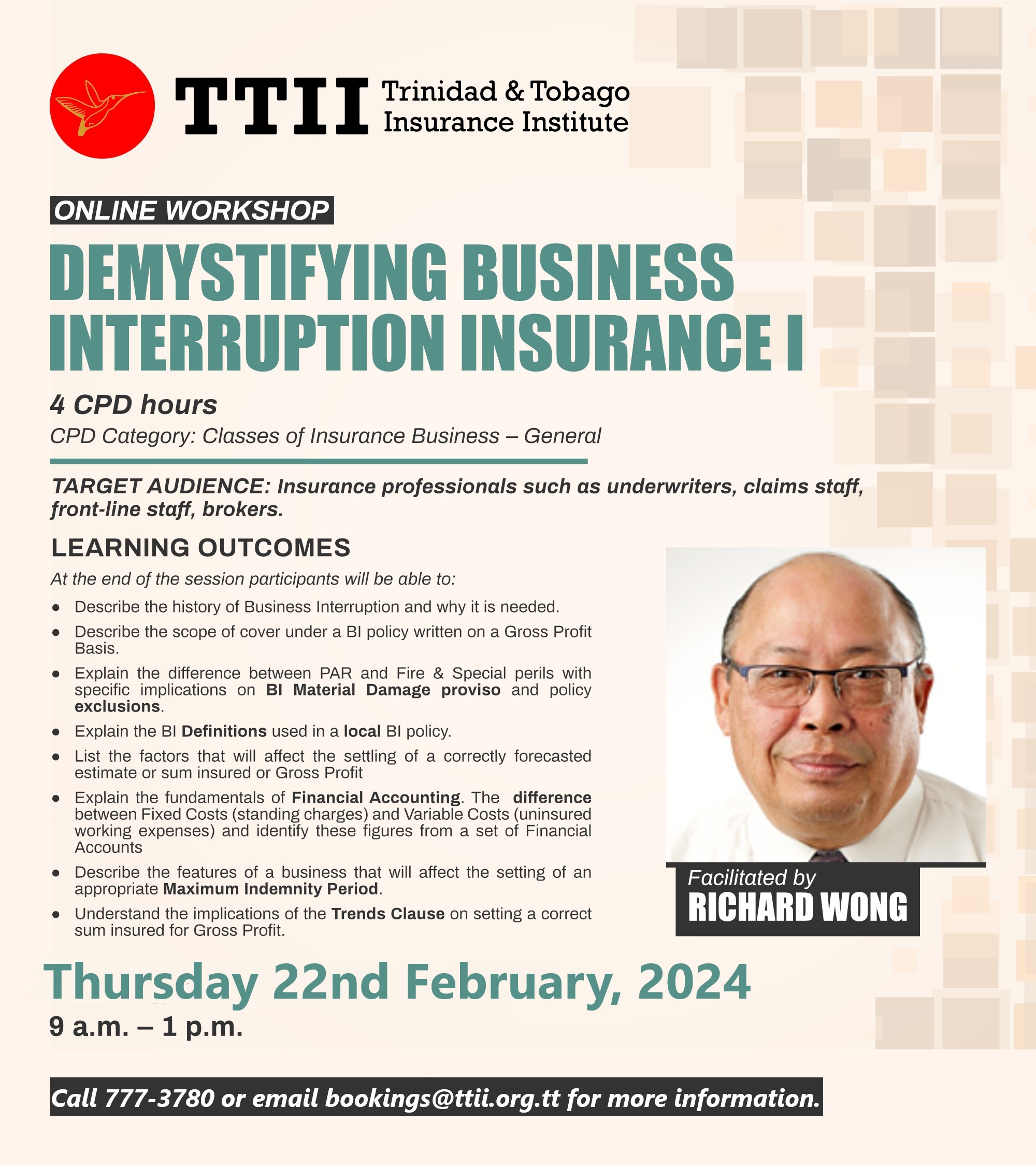

At the end of the session participants will be able to:

- Describe the history of Business Interruption and why it is needed

- Describe the scope of cover under a BI policy written on a Gross Profit Basis

- Explain the difference between PAR and Fire & Special perils with specific implications on BI Material Damage proviso and policy exclusions.

- Explain the BI Definitions used in a local BI policy.

List the factors that will affect the settling of a correctly forecasted estimate or sum insured or Gross Profit

- Explain the fundamentals of Financial Accounting. The difference between Fixed Costs (standing charges) and Variable Costs (uninsured working expenses) and identify these figures from a set of Financial Accounts

- Describe the features of a business that will affect the setting of an appropriate Maximum Indemnity Period.

- Understand the implications of the Trends Clause on setting a correct sum insured for Gross Profit.