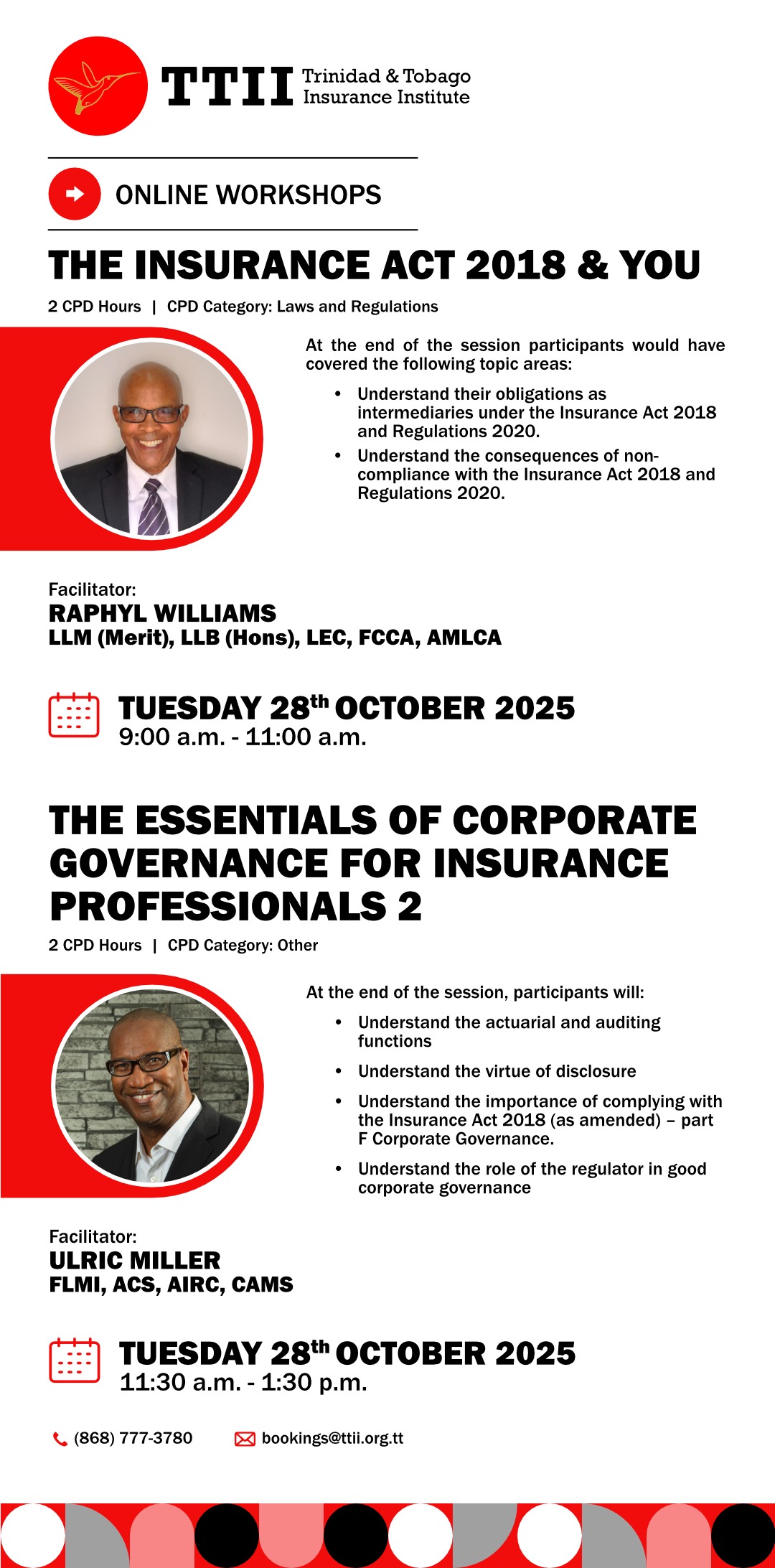

The Insurance Act 2018 & You and The Essentials of Corporate Governance for Insurance Professionals 2

Price: $0.00

October 28, 2025

The Ins Act 2018 & You

This workshop is designed to educate participants about their requirements under the IA 2018 and Regulations. They will gain a comprehensive understanding of their obligations and the consequences of non-compliance with the Insurance Act and Regulations.

The Essentials of Corporate Governance for Insurance Professionals 2

This workshop is designed to educate participants on corporate governance as a system of rules, practices, and processes by which an insurance company is governed. It includes corporate structure (board of directors, senior management, business area functions, etc.), the company’s organizational culture (values, ethics, etc.), strategies, controls, as well as all the governing documents that capture the spirit and the letter of a company’s guiding principles and mandates.

The Ins Act 2018 & You

At the end of the session, participants will be able to:

- Understand their obligations as intermediaries under the Insurance Act 2018 and Regulations 2020.

- Understand the consequences of non-compliance with the Insurance Act 2018 and Regulations 2020.

The Essentials of Corporate Governance for Insurance Professionals 2

At the end of the session, participants will:

- Understand the actuarial and auditing functions

- Understand the virtue of disclosure

- Understand the importance of complying with the Insurance Act 2018 (as amended) – part F Corporate Governance.

- Understand the role of the regulator in good corporate governance

The Ins Act 2018 & You

Facilitator: Raphyl Williams, LLM (Merit), LLB (Hons), LEC, FCCA, AMLCA

Mr. Williams who is the TTII’s Director of Education, is also an Attorney at Law, and has operated in a number of senior positions including Managing Director and Chief Financial Officer for a number of organisations within a major conglomerate.

Mr. Williams holds a Master’s degree (LLM) in Commercial and Corporate Law and a Bachelor of Laws Degree (LLB) from the University of London. He is also a Fellow of the Association of Certified Chartered Accountants (FCCA) and a member of the Institute of Chartered Accountants of Trinidad and Tobago (ICATT).

Mr. Ulric Miller (FLMI, ACS, AIRC, CAMS) is certainly no stranger to the Insurance Industry and has over 45 years’ experience. More specifically, his role as a TTII lecturer and trainer has spanned a diverse range of subject areas namely Long-term Insurance Business, AML/CFT/CPF, strategic planning and Ethics. His historical roots run deeply in the TTII, as he also served as President of the Council of Trustees. Regionally, he has held the position of 1st Vice President of the Association of Insurance Institutes of the Caribbean (AIIC). He has also served as an adept change manager with special experience in leveraging IT, possesses a highly successful track record in Customer Relationship Management, Strategic Management and Scenario Planning. His unwavering dedication to leadership and management is reflected in his service as a member on various state and private boards.

Mr. Miller holds the designation as a Fellow of the Life Management Institute which demonstrates his in-depth knowledge and expertise in the field of long-term insurance management. Among his other accolades are Certified Anti-Money Laundering Specialist (CAMS) and Associate in Insurance Regulatory Compliance (AIRC).

The Essentials of Corporate Governance for Insurance Professionals 2

Bookings are closed for this event.